- The crypto market declined by 6.48% (about $240 billion) yesterday as Bitcoin dropped from $101,000 to a every day low of $93,000, resulting in $750 million in liquidations.

- The correction in main cryptos has begun, with some alts already recording double-digit worth will increase.

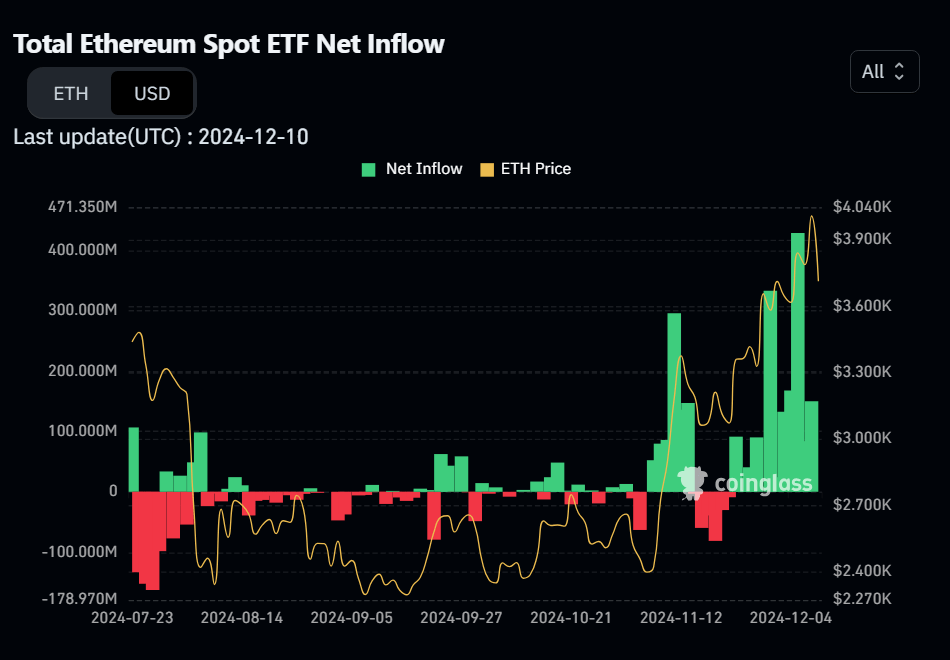

- In the meantime, Bitcoin and Ethereum spot ETFs proceed to see constructive inflows.

Bitcoin The buying and selling session declined yesterday, falling from the every day opening worth of $101,151 to a low of $94,270 through the US afternoon session after which closed as excessive as $97,314. With over 56% market dominance, the most important crypto by market cap put stress on all the market as main altcoins recorded double-digit losses.

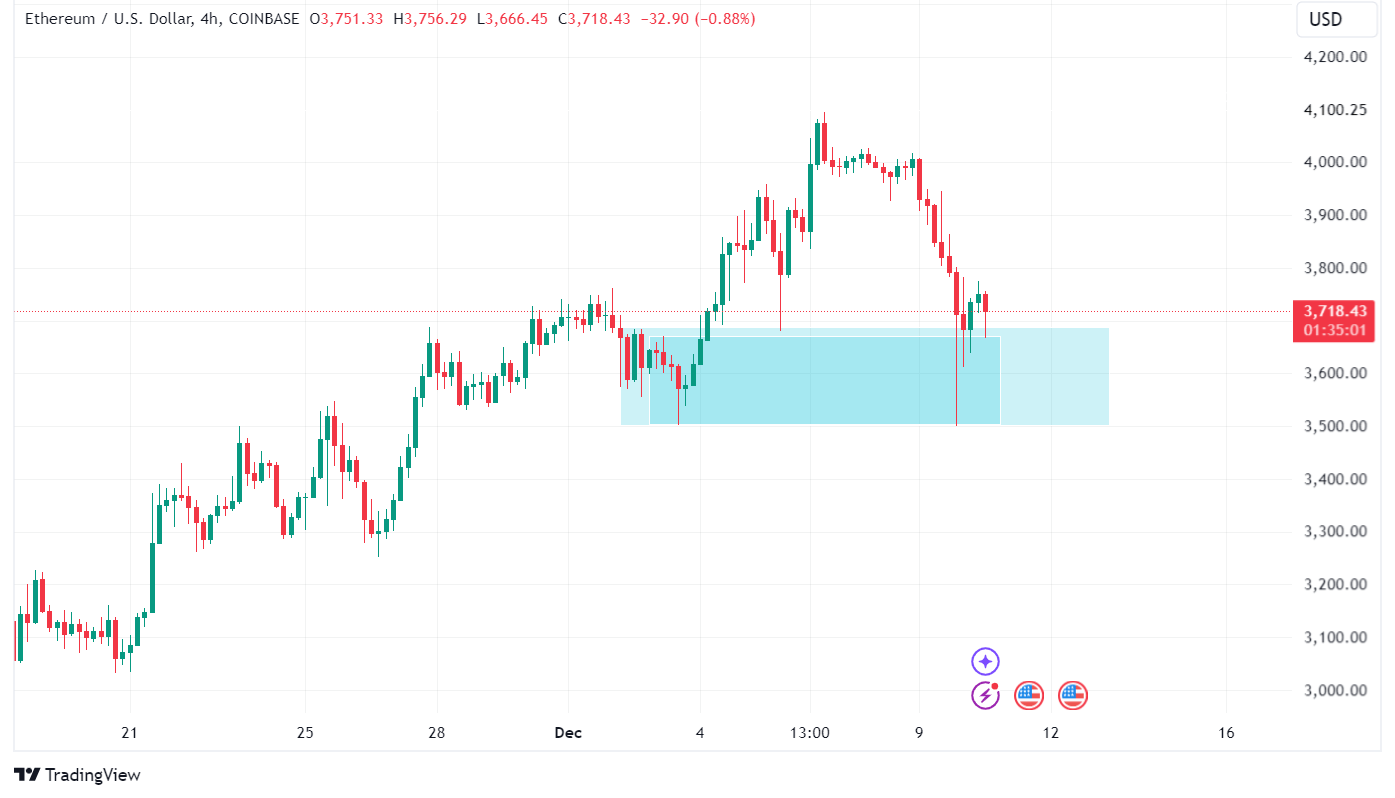

Nonetheless, in the beginning of at the moment’s US buying and selling session, some main altcoins look like discovering help. Ethereum reached a every day low of $3,506 yesterday and is 5% above that stage on the time of writing, whereas Solana is up 6.9% from yesterday’s low.

Is the sell-off over?

bitcoin price The worth has been pushed down right into a help zone with an higher restrict of $97,463 and whereas a lot of the promoting stress has subsided, its worth remains to be hovering across the help as particular initiative shopping for motion has not taken place but.

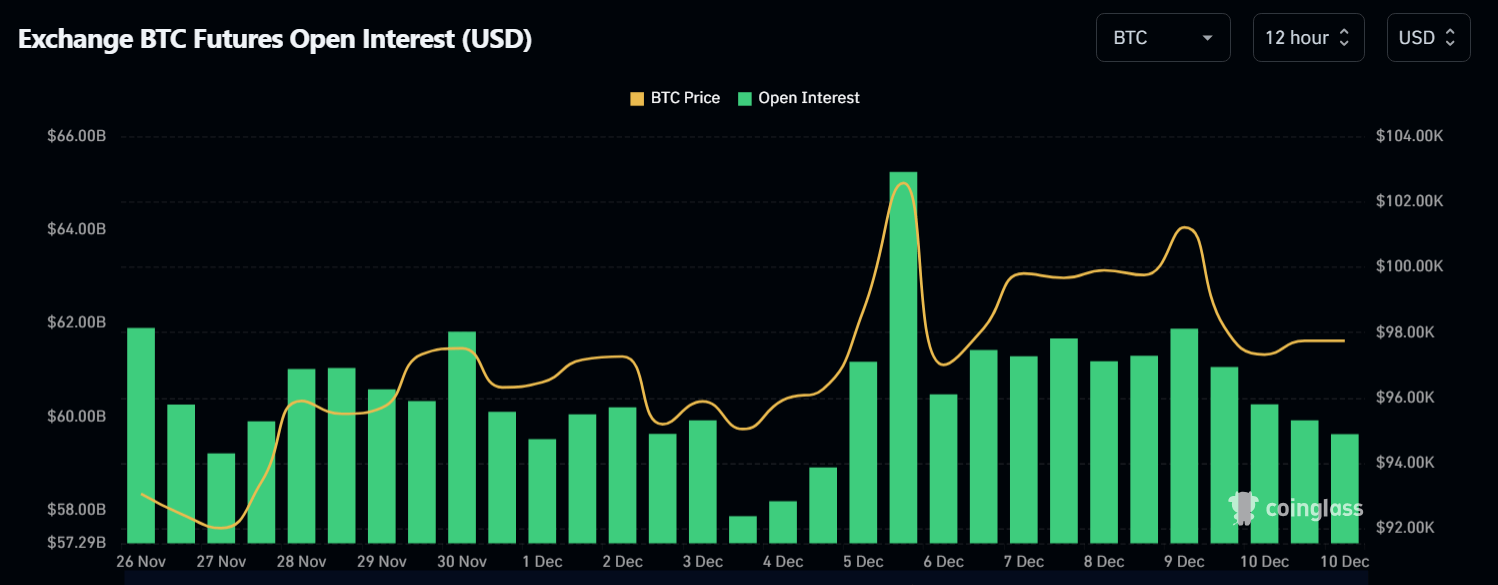

Open Curiosity has decreased from yesterday because of closing of extra positions because of liquidation and revenue taking. Nonetheless, a transparent signal of resumption of the uptrend can be a rise in open curiosity together with constructive worth motion, which might point out the opening of latest positions.

Ethereum price The motion is much like how the second-largest cryptocurrency by market cap hovers round a help stage, ready for both initiative shopping for motion to push the worth larger or sellers to push the worth decrease.

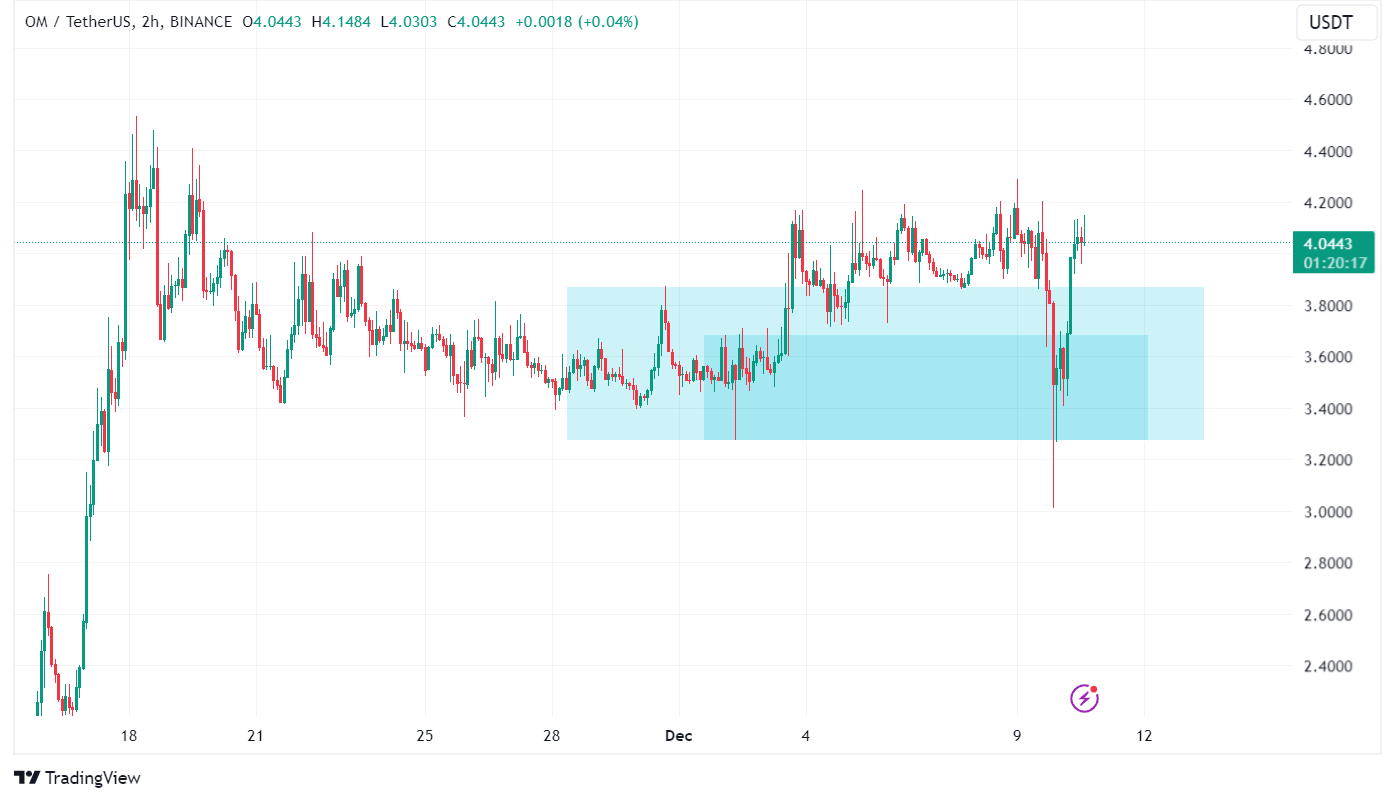

Elsewhere, some altcoins have virtually utterly erased yesterday’s decline, and have recorded double-digit every day positive aspects on the time of writing. Mantra is a superb instance of this as on the time of writing its worth is up 14.11% since yesterday’s shut.

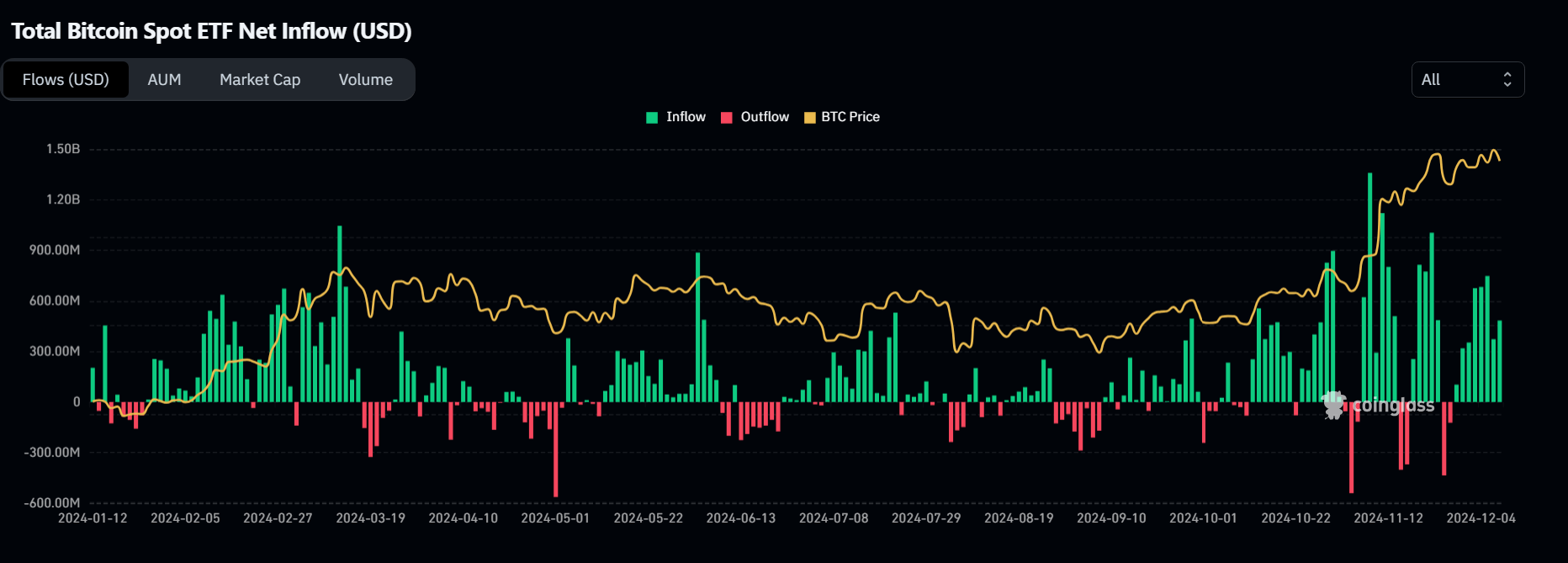

Spot crypto ETF flows stay regular

Yesterday’s decline isn’t indicative of broader bearish sentiment as inflows into US crypto spot ETFs stay constructive. US spot Bitcoin ETFs recorded inflows of $2.77 billion final week and $483.60 million yesterday.

Ethereum ETFs additionally adopted an identical sample and recorded weekly inflows of $836.8 million and $149.80 million yesterday.

On the time of publication Bitcoin trades at $97,900 whereas Ethereum trades at $3,600.