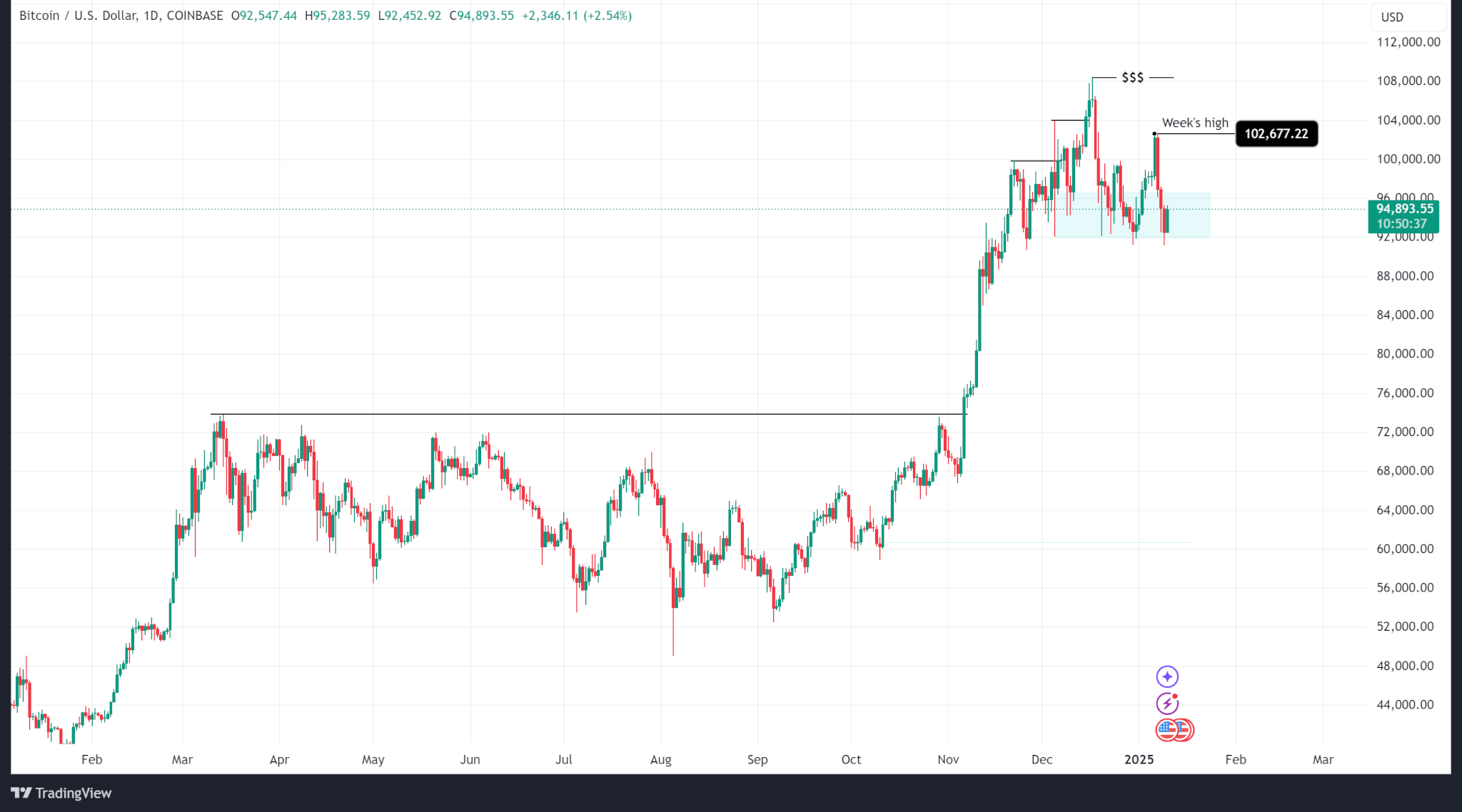

- Bitcoin examined the $92,000 stage yesterday after falling from the weekly excessive of $102,000 as promoting stress elevated.

- Macroeconomic components increase doubts about market power as sticky inflation turns into a priority

- Spot crypto ETFs recorded huge outflows on Wednesday after Fed assembly notes have been launched

bitcoin price It has fallen from a excessive of $102,667 on Tuesday, January 7 to $94,890.00 on the time of publication, however stays throughout the final H4 demand zone.

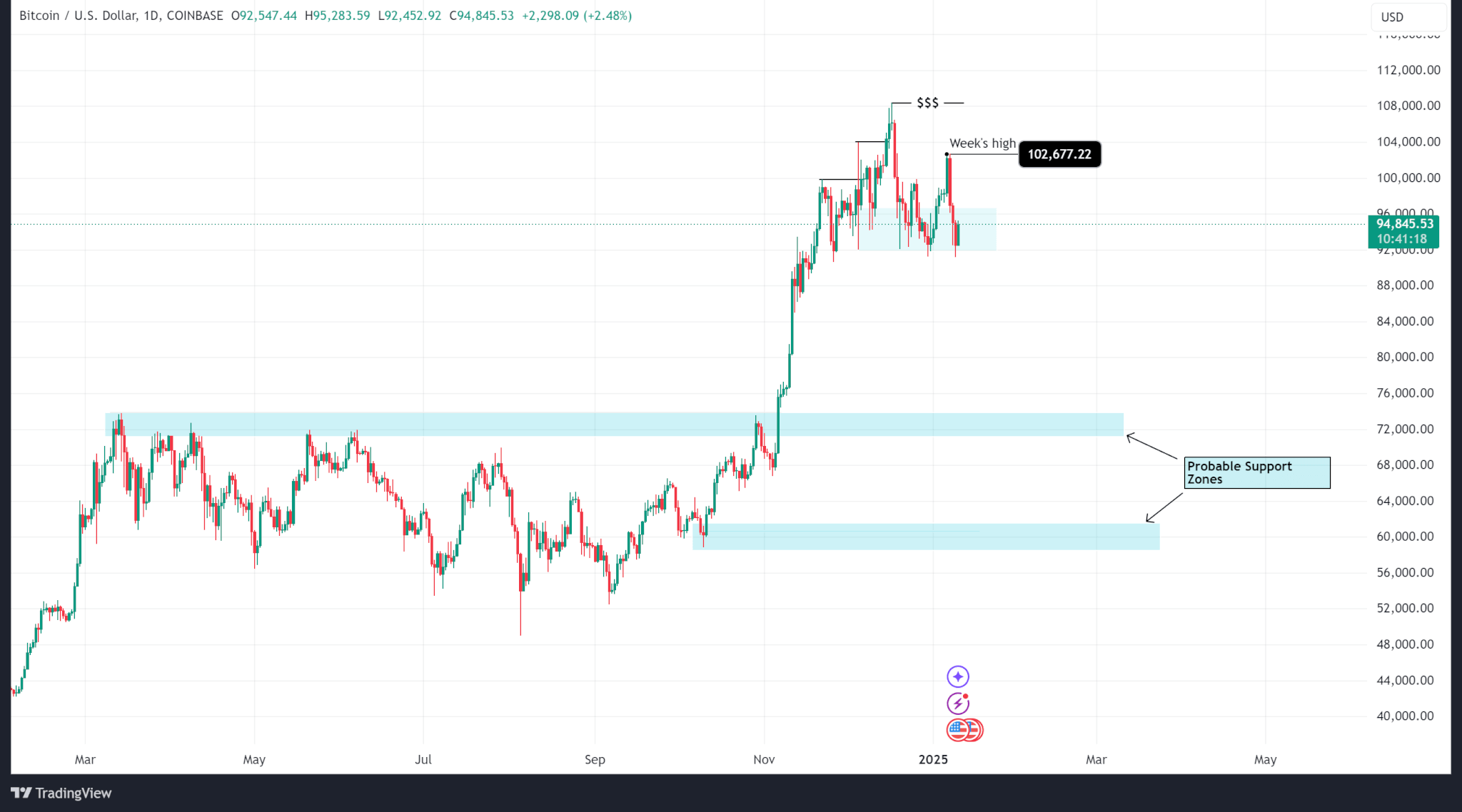

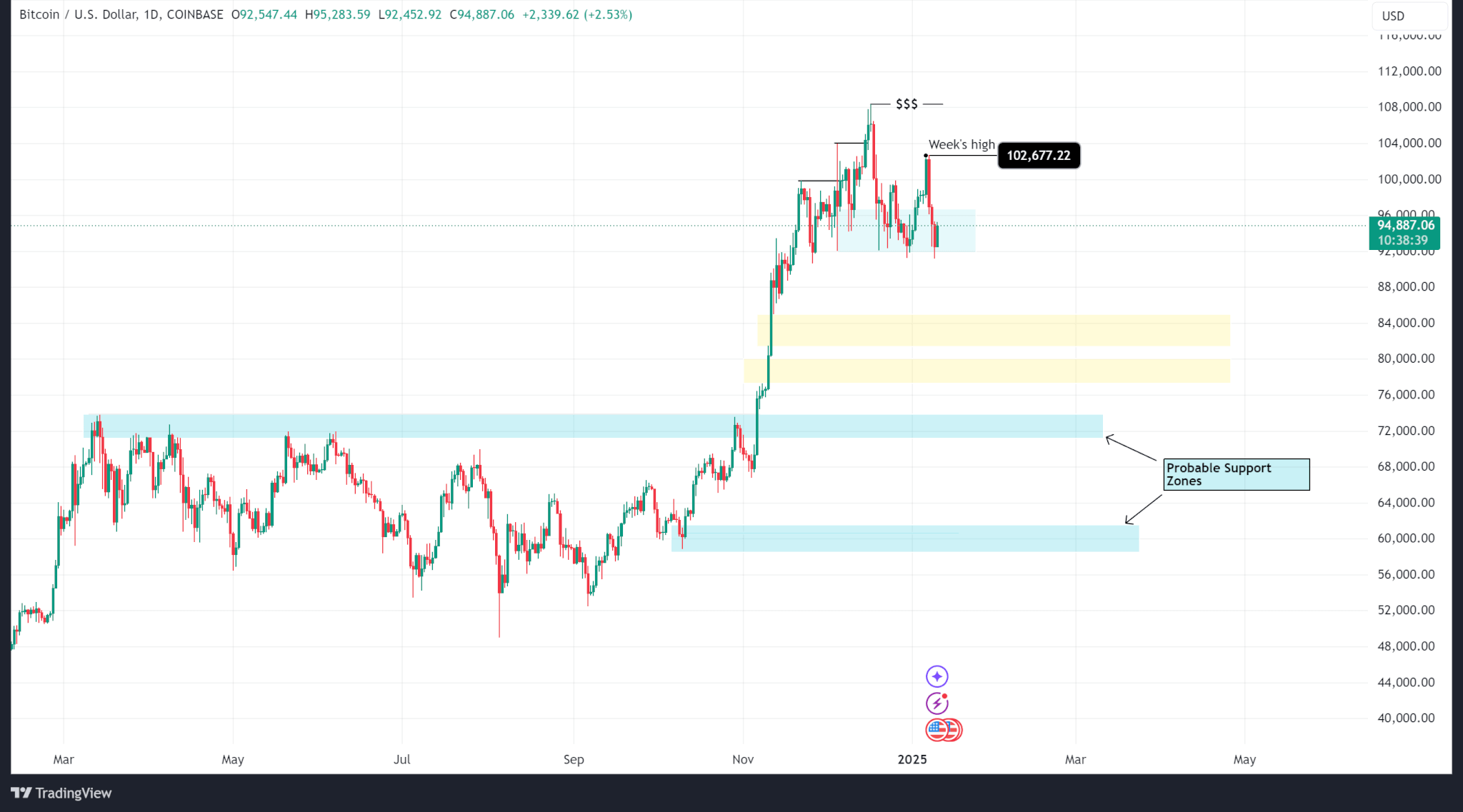

Whereas the demand zone between $92,000 and $97,000 stands out as the remaining help stage on the H4 timeframe, a broader market view means that btc Is in premium territory on the each day timeframe. In consequence, a push beneath $92,000 nonetheless retains the worth in bullish territory.

The most effective technical purchase stage can be both on the final break of the construction on the each day timeframe or on the 50% Fibonacci stage from the bottom level to the break.

There are two cheap worth intervals from which the worth can react. Though they aren’t key areas, they may help a continuation of the exterior excessive at $108,000 or a short reduction rally earlier than persevering with promoting into the primary potential help zone as lately reported. Tradingview analysis of btc,

That is all primarily based on Bitcoin falling beneath the $91,000 stage.

Throughout this time, spot crypto etf The document outflows adopted the discharge of the minutes of the US Federal Reserve assembly on Wednesday, January 9. These confirmed that the Fed is cautious about inflation and the results of Trump’s upcoming insurance policies.

btc etf Whereas $568.8 million was drained on Wednesday eth etf $159.4 million was misplaced, with the most important outflow coming from Constancy ($258.7 million for BTC and $147.7 million for ETH).